A Personal Touch: Text Messaging for Loan Repayment

Organization : B-Hub Editorial Team

Project Overview

Project Summary

Microlenders in the Philippines sent personalized text message reminders to their clients each week around the time that loan payments were due.

Impact

Text messages with a positive framing and signed by the account officer reduced the likelihood of having an unpaid balance after 30 days from 13.5% to 3.5%.

Challenge

Microlenders expand access to credit markets to individuals by offering small loans to those who would might not be eligible for more traditional loans. Many people, however, do not make timely payments on their loans resulting in costly consequences for both the borrower and the bank. The borrowers are charged late fees, experience declines in creditworthiness, and might be subject to legal action. Meanwhile, the bank has to expend additional resources to try to recoup the value of the original loan.

The researchers found that late payments are incredibly common: 29% of payments are made one day late, 16% are paid one week late, and 14% of the loans are not paid within 30 days of the maturity date. By increasing timely repayment of loans, individuals can avoid the fees associated with late payment.

Design

The research team worked with two Filipino microlenders, Greenbank and Mabitac, to design various text messages to be sent to individuals around the date that their loan was due to be repaid. Both the content and timing of the text messages varied. Loan payments were due weekly and borrowers received text messages on either the day that payment was due, the day before payment was due, or two days before payment was due, until the maturity of their loan.

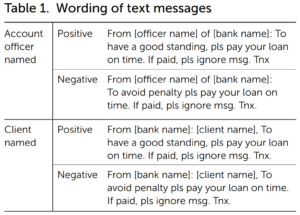

In addition to how timing the text message might affect repayment, the researchers were also interested in the effects of positive or negative framing and personalization – whether it was more effective to mention the client’s or the account officer’s name. Borrowers were randomly assigned to receive one of four types of messages shown below, or no message at all.

Impact

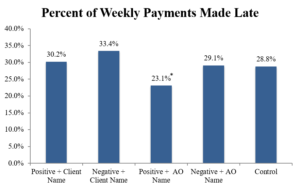

A randomized evaluation found that most of the messages failed to achieve any significant result on loan repayment. The only message that increased repayment rates was a positive framing and the inclusion of the account officer’s name. These messages resulted in a 6.2 percentage point decline in late payments from 28.8% to 23.1% relative to those who did not receive any text messages. Furthermore, they found that the probability that a loan would remain unpaid after 30 days decreased from 13.5% for the no-message control group to 3.5% for individuals who received a positively framed text message with the account officer’s name. It is important to note, however, that the messages were only effective for individuals who had previously borrowed from the bank, and thus had a pre-existing relationship with the account officer. The timing of the text messages had no affect on the likelihood that an individual would make a timely payment.

* Significantly different from control (no message) group (p<.05)

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researchers:

- The most effective communication method might differ depending on the target population. The Philippines were the ideal location for this study because 81% of the population had a cell phone subscription as of 2009. In regions where cell phone usage is not as pervasive, text message interventions might be less effective.

- Building relationships can make people more responsive. One of the key takeaways from this study was that referencing a pre-existing relationship made individuals more likely to make timely payments.

- Conversations with bank management indicate that the loan repayment improvements seen here would produce cost savings that greatly exceed the cost of messaging.

Project Credits

Researchers:

Dean Karlan Northwestern University

Melanie Morten Stanford University

Jonathan Zinman Dartmouth College