Framing Advertising for Consumer Loans

Organizations : ideas42, Innovations for Poverty Action

Project Overview

Project Summary

A consumer lender in South Africa sent mailers to previous clients advertising new loans at a discounted interest rate.

Impact

The best performing creative content produced a 12% average increase in loan applications. Extending the deadline by two weeks proved the most effective, increasing average take-up of the special offer by 35%.

Source

Source

Challenge

Advertisements often include some combination of informational and “creative” content such as images, phrasing, and the inclusion of superfluous information. The non-informative content is known to be important, but it’s often difficult to discern how important this content is relative to changes in price.

Retailers often include expiration dates when they offer discounts to clients. A more distant expiration date allows consumers to make the purchase when it is most convenient for them but can also lead to procrastination. By choosing an expiration date that strikes the right balance, consumer lenders can maximize the number of individuals who take advantage of a lower interest rate.

Design

Researchers partnered with a consumer lender in South Africa to design mailers advertising new loans at discounted interest rates to former clients with varying deadlines. The researchers gave clients either 2, 4, or 6 weeks from the date that the mailer was sent to take advantage of the special rate. The special rates were “low,” “medium,” or “high,” with 97% of interest rates offered being below the standard rate. The designs also differed in the creative content that they contained. In total, there were eight different creative features that the researchers varied:

- Photo – The researchers tested several different photos with models of different races and genders.

- Number of example loans displayed – The mailer contained either one or four example loans. Among the four loans, they showed either one or four maturity dates.

- Interest rate shown in examples – Some example loans displayed the interest rate and the monthly payments, whereas others only displayed the monthly payments.

- Suggested loan use – In some of the mailers they included possible loan uses such as “pay for school” or “repair your home.”

- Comparison to competitor rate – Most of the mailers compared the lender’s rate to their competitors using either loss or gain framing.

- Cell phone raffle – In 25% of the mailers, they advertised a cell phone raffle that the applicant would be entered into if they applied for a loan.

- Client’s language – They varied whether they included text reading “We speak [client’s language].”

- Advertised as a discount – In 75% of the mailers, the interest rate was described as “special” or “low.”

The individual mailers that households received contained different combinations of the eight features. Example mailers can be found below.

Impact

While the average take-up rate for all loan offers was 8.5%, this randomized evaluation found that extending the deadline to apply by two weeks (from 2 weeks to 4 weeks, or from 4 weeks to 6 weeks) increased the probability of applying by 3 percentage points, roughly equivalent to the increase achieved by reducing the interest rate 10 percentage points.

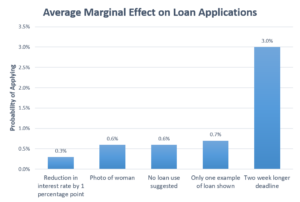

Of the many variations in advertising content that were tested, the three features that significantly increased the likelihood individuals would apply for a loan were: a female photo, one example loan, and no suggested use. Each of these three treatments increased loan applications (and successful loans) similar to a 2-percentage point or more reduction in the interest rate. It is important to note, however, that these results should be interpreted with caution since so many different features were tested. Furthermore, the researchers found that these specific variations in creative content were only statistically significant among males, and that none of the creative content treatments were statistically significant for women.

Individual features with significant effects on loan demand (p<.05). Insignificant content features not shown.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researchers:

- Context and framing matter. Think carefully about the creative content on your mailer and evaluate which designs are most effective for your target population. It is difficult to predict which variations in content will affect demand. Systematic field testing helps identify which small details might make a big difference.

- Account for the delay in direct mail. While all individuals received the mailer within two weeks, the researchers are unsure if all opened the mailer before the special rate expired.

- Set a reasonable deadline. The authors found that a six-week deadline maximized take-up of their special offer. They warn, however, that increasing the deadline more might not have similar success.

- For more advice on how to design an effective mailer check out the B-Hub checklist!

Project Credits

Researchers:

Marianne Bertrand University of Chicago

Dean Karlan Northwestern University

Sendhil Mullainathan Harvard University

Eldar Shafir Princeton University

Jonathan Zinman Dartmouth College