Nudging Tax Compliance with the Human Touch

Organization : Inter-American Development Bank

Project Overview

Project Summary

The National Tax Agency of Colombia (DIAN) conducted a field experiment using phone calls to communicate with taxpayers to recover unpaid debts.

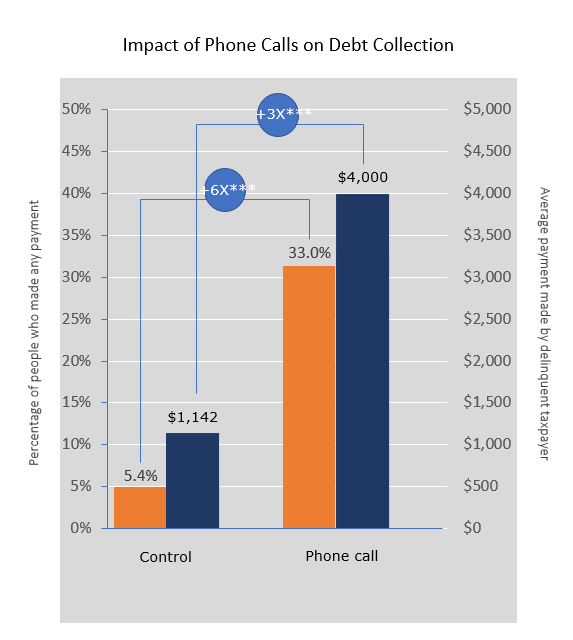

Impact

The payment rate among taxpayers who received a personal phone call was about 25 percentage points higher than the control group (about a five – fold increase), and their average payment was about 3 times higher.

Challenge

Tax delinquencies are a major problem for most tax administrations in the world. In Colombia, the National Accountant Office estimated the total outstanding debt to the National Tax Agency at $2.5 billion, which represents about 20 percent of estimated total tax evasion in 2014. Finding ways to reduce tax delinquencies is critical for both fiscal and equity considerations. A previous study compared messages about due liabilities delivered through three channels (letter, email, or personal visits). This study explored the use of personal phone calls, a method extensively used in the context of political canvassing, to contact taxpayers for the purpose of increasing tax compliance.

Design

The National Tax Agency of Colombia (DIAN) randomly assigned a sample of 34,783 taxpayers with due tax liabilities to either receive a phone call, or not receive any notification (control).

The individual making the call had to follow a detailed script after the connection had been established:

- The caller reminded the taxpayer of outstanding debts to DIAN, without mentioning the specific amount.

- The caller further mentioned possible legal and financial sanctions.

- The caller attempted to schedule the taxpayer to an appointment at the DIAN office, where the taxpayer was offered the opportunity to clarify current account delinquencies, resolve any disputes, and arrange a payment. Alternatively, the taxpayer compromises to pay by a certain date.

- At the end of the call, the agent thanked the taxpayer for her time and mentioned the campaign slogan “Colombia, a commitment we can’t evade.”

The contents of the script attempt to affect the deterrence and moral suasion channels of compliance. Importantly, the script proceeds as a conversation rather than a rigid text, with multiple interactions between the agent and the taxpayer in order to foster personal interaction. Moreover, the invitation to attend a meeting at the tax agency further emphasizes personal interactions. The call produces two main outcomes: an appointment at the local agency office or a verbal payment commitment.

DIAN script for phone calls.

Impact

The randomized evaluation found that personal phone calls were very effective in increasing collection of unpaid taxes. In the control group without notifications, which represented the absence of any campaign, only about 5.4% of individuals with tax delinquencies at the beginning of the year made any payment by the end of the year. Compared to this base scenario, about 11 percent of the taxpayers assigned to the intervention made any payment, payments were 50% higher, and the agency recovered 6% of the total debt on average.

Among taxpayers who actually received a phone call, their payment rate was about 25 percentage points higher than the control group, and their average payment was about 3 times that of the control. Each attempted call resulted in $470 in recovered debt, and almost $4,000 per actually contacted taxpayers.

Impact of phone calls on percentage of people who made any payment (orange) and average payment made by the delinquent taxpayer (blue). This comparison is conditional on the phone call being made, and all results are statistically significant (p < .001)

The intervention works differently across several observable characteristics of the taxpayers. First, the probability of payment is higher the lower the level of debt is. Second, phone calls seem to be less effective for businesses than for individuals. Third, VAT and income tax debtors seem to react more readily than debtors of the wealth tax. Finally, there is some evidence of negative effects on the phone calls for chronic debtors.

Although most people reached agreed to have a meeting with an agent at the DIAN office, only 69% attended the meeting. Of those who attended the meeting, 50% committed to pay, and then only have of them actually did. Among those who did not agree to attend the meeting (only 6%), half of them still committed to pay, but only 39% of them actually did.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researchers:

- Since the level of debt can change from the moment the notes are written to the moment the call takes place, the script did not mention the specific amount outstanding to avoid false expectations.

- The results indicate that the probability of payment is higher the lower the level of debt is, suggesting the tax authority should be very vigilant in contacting taxpayers when the debt is low and recent and avoid letting debts persist and grow over time. Otherwise, payment plans may be needed to increase compliance with the wealth tax for people with cash flow restrictions.

- Commitments and plan-making strategies seem to work better in compliance than in other policy areas where it has been used so far.

- Compared to previous estimates in the literature, the effect of phone calls on the probability of payment is greater than the effect of more impersonal methods (letter and email) but less than more personal outreach methods like in-person visits to the taxpayer.

- Phone call campaigns, like others have some limitations. First, if databases are not up to date, the contact rate could be low. Second, chronic debtors may find ways to avoid being contacted as technology progresses. Third, phone calls may be less effective with certain populations, such as businesses. Combining cost-effective interventions targeted to the majority of taxpayers, with limited phone calls for one group and personal visits with harsher prosecution for the small set of debtors might be the best strategy.

- The initial distribution comprised 24,870 subjects in the treatment group and 9,913 in the control group. However, the tax agency decided to stop the intervention once 12,853 calls had been made (a little over half of the total planned). Out of the group of taxpayers assigned to the intervention, 5,267 were contacted (21% of the total and about 40% of total calls made). The contact rate (share of effective contacts over the number of calls made) is similar to contact rates from specialized phone banks in recent GOVT interventions.1

Project Credits

Researchers:

Mónica Mogollón Rutgers University

Daniel Ortega The Development Bank of Latin America (CAF)

Carlos Scartascini Inter-American Development Bank

1 Mann , Christopher B., and Casey A. Klofstad. 2015. “The Role of Call Quality in Voter Mobilization: Implications for Electoral Outcomes and Experimental Design.” Political Behavior , 37(1): 135–154