A Helping Hand Boosts College Enrollment

Organization : B-Hub Editorial Team

Project Overview

Project Summary

Tax professionals worked with families to streamline the process of submitting the FAFSA.

Impact

Assistance in completing the FAFSA increased college enrollment among high school seniors by 8.1 percentage points. They were also 8 percentage points more likely to have completed two years of college within the next three years.

Cost

$87.50 per participant, broken down as follows: $2.50 for the training and time of the tax professionals, $15 for materials, $30 for call center support, and $40 for participation incentives ($20 for the tax professional and $20 for the participants).

Challenge

Each year millions of individuals decide whether they should attend college, or if they’re already attending, they choose whether to remain enrolled. There are many factors that influence this critical decision, but one of the most important is the availability of financial aid. In the United States, a household’s Free Application for Federal Student Aid (FAFSA) determines the amount of public (and often private) need-based aid available to them. The FAFSA is a lengthy and onerous form with over 100 detailed questions covering a vast number of topics such as “government benefits, parental education attainment, driver’s license number, previous drug convictions, and intended college plans.” As a result of the complexity of the application, many individuals who might otherwise attend college neglect to complete the FAFSA and are then ineligible for federal student aid.

Design

A group of researchers partnered with H&R Block, a tax preparation assistance company, to test the effects of streamlining the FAFSA completion process. After their tax forms were filed, low-income (less than $45,000) families with at least one member between the ages of 15 and 30 who did not already have a bachelor’s degree were asked if they wanted to take part in an H&R Block study of how individuals make decisions about attending and paying for college. Participants were asked general questions about their backgrounds and higher education perceptions and then received either:

- A basic informational pamphlet about college and financial aid.

- Individualized descriptions of their financial aid eligibility and the estimated cost of attending nearby colleges.

- Information on individual aid eligibility and costs of attending nearby colleges, as well as assistance in completing and submitting the FAFSA. Tax preparation professionals were able to pre-populate many of the FAFSA questions using information from the tax returns, and the interview to answer the remaining questions took less than 10 minutes for most individuals. If completed during the visit, H&R Block then offered to submit the FAFSA electronically for them. If more information was needed, an external call center reached out to the family to ask the remaining questions and offered to submit the form.

Impact

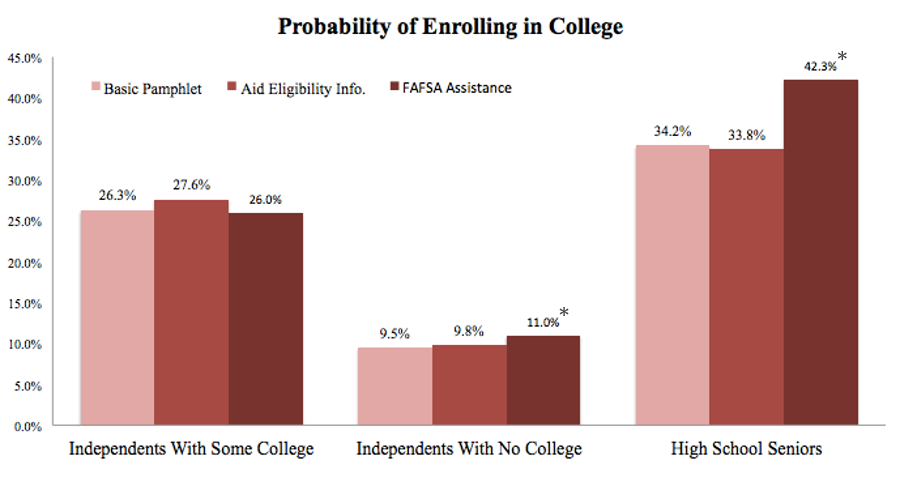

A randomized evaluation found that tax professionals’ assistance in filling out the FAFSA led to significant increases in both the likelihood that individuals would go to college and that they would receive a Pell Grant. High school seniors benefited most from this assistance, which increased their college enrollment by 8.1 percentage points (from 34.2% to 42.3%) compared to those whose families received only the basic informational pamphlet. They were also 10.6 percentage points (from 29.6% to 40.2%) more likely to receive a Pell Grant and attend college than those who were given the pamphlet alone. Furthermore, these high school seniors were also 8 percentage points more likely to have completed two years of college (from 28% to 36%) during the first three years following the intervention.

The FAFSA assistance was also mildly effective for older family members who filed their taxes as an independent and had no prior college education. For these individuals, receiving the FAFSA assistance increased the average likelihood they would attend college by 1.5 percentage points, from 9.5% to 11.0%, compared to individuals who only received the informational pamphlet. Additionally, independents with no prior college education were 3 percentage points (11.1% compared to 14.1%) more likely to attend college and receive a Pell Grant than those who only received the basic pamphlet.

The FAFSA assistance had no effect on college enrollment among older family members who file as independent, but have some prior college education.

Receiving information on individualized financial aid eligibility along with the estimated costs of attending local colleges did not increase the likelihood that an individual would attend college or that they would receive a Pell Grant over receiving the basic information pamphlet alone.

* Significantly different from basic pamphlet group (p<0.05)

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researcher:

- Since the main outcomes of interest were college enrollment and the receipt of Pell Grants, the researchers had to partner with multiple organizations and governmental agencies, including the Ohio Board of Regents, the National Student Clearinghouse, and the Department of Education, to obtain the necessary outcome data.

- While some individuals were unable to complete their FAFSA at the H&R Block location, they were able to take their mostly completed FAFSA with them and submit it at a future point in time. This allowed for the process of submitting the FAFSA to be less burdensome even if they were unable to complete the FAFSA on site. Furthermore, H&R Block provided a call center that was available to answer any questions families may have and actively reached out to families in the FAFSA Assistance group who had not yet completed their FAFSA.

- Providing an incentive for participation can attract some individuals who would often choose not to participate otherwise. In this experiment, individuals who chose to participate received a $20 discount on their tax preparation. Half of the participants said they volunteered in order to learn more about college, but the other half said they did so only to receive the discount.

- When designing an intervention try to think about what obstacles pose the most pressing barriers. When it comes to the FAFSA the most significant barriers to completion are the length and the complexity. This barrier was easily overcome through personal assistance and the pre-population of forms. About two-thirds of the FAFSA could be pre-populated using information from households’ tax returns.

- Choose a comparison group that makes sense for this intervention. Not every intervention can have a control group where “nothing” is done to them. In this case, the control group received a pamphlet containing information about college that was readily available online.

- Immediate personal assistance for completion of onerous tasks can be both cost-effective and efficient. In this case, providing assistance to overcome one step of a multi step process greatly increased completion of the overall process to attend college. Students still needed to submit their college application themselves.

Project Credits

Researchers:

Eric P. Bettinger Stanford University

Bridget Terry Long Harvard University

Philip Oreopoulos University of Toronto

Lisa Sanbonmatsu Harvard University