Account Opening Process to Increase Intentional Savings

Organization : ideas42

Project Overview

Project Summary

CARD Bank redesigned a popular savings account to include a new account opening form, a printed savings plan, optional reminders to make savings deposits, and a new savings calendar.

Impact

Clients who received the redesigned savings program increased their final balances by 37%, from an average of 86 pesos among clients in the standard savings program to an average of 118 pesos among those in the redesigned program.

Challenge

In the Philippines, many people would benefit from being able to save relatively small sums of money. Even small amounts of savings allow them to have greater financial stability and/or invest in items that could improve their standard of living.

CARD Bank has been working on this challenge. Though the bank was able to get 34,000 accounts in a 15-month period, 58% of the accounts at CARD Bank had not been used since being opened – not one single transaction. Many clients opened new accounts without an intention or plan about how to use them and would not enroll in regular savings collection programs because they were not made salient when the account was being opened. Furthermore, savings goals are distant and abstract, and seem less pressing than today’s financial temptations.

Design

ideas42 redesigned four aspects of the CARD Bank system to increase savings: a new account opening form, a printed savings plan, reminders to make savings deposits, and a new savings calendar.

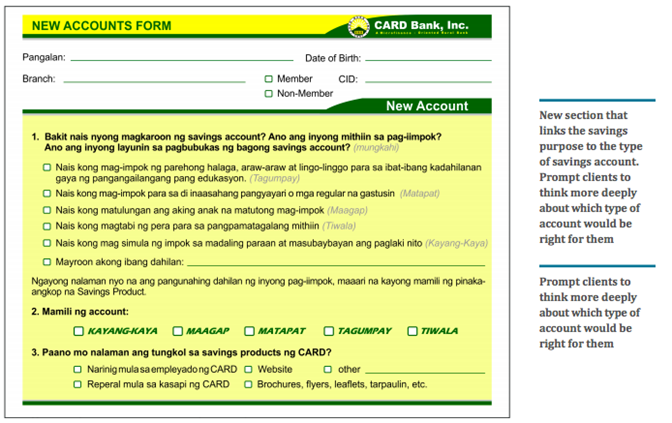

The redesigned “New Account Opening Form” was shorter, simpler, and more straightforward to help new clients think more deeply about which type of account is right for them, as many clients had been opening accounts with no plan for how to use them.

The redesigned New Account Opening Form

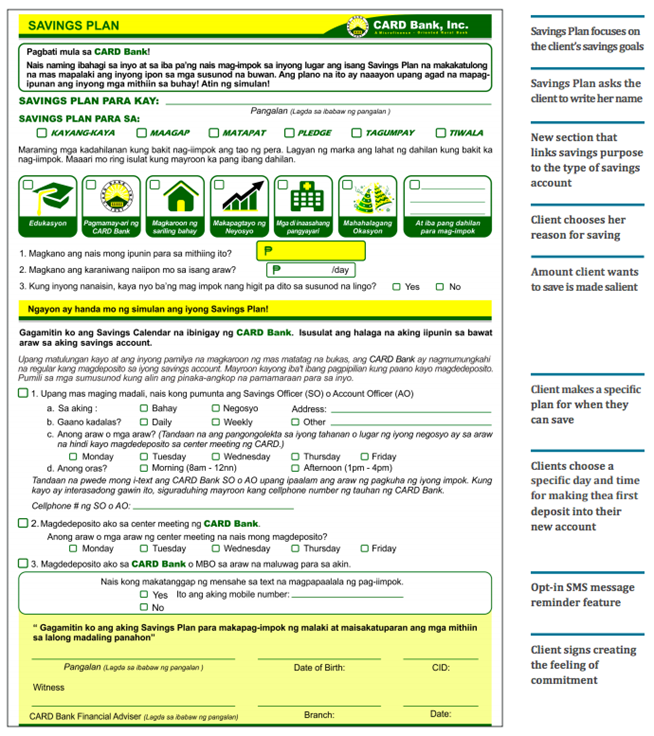

The new savings form asked new clients to identify an amount for their savings goal to steer clients away from anchoring their payment amounts to the minimum required payment. After soliciting desired savings amounts, clients were asked a series of questions about their plan to make their first deposit and future deposits. The plan also included a prominently displayed question asking clients if they wanted to sign up for free savings collections. Upon completing the form, both the client and a member of the bank staff signed the savings plan form to create a feeling of commitment to CARD Bank. Clients were allowed to take copies of this agreement home with them.

The new Savings Plan

The savings plan also allowed clients to opt-in to receive text message reminders to make savings deposits. The text messages were designed to appear to come from a specific CARD Bank staff person, rather than a computer system, to build upon the strong relationship that clients had with CARD Bank.

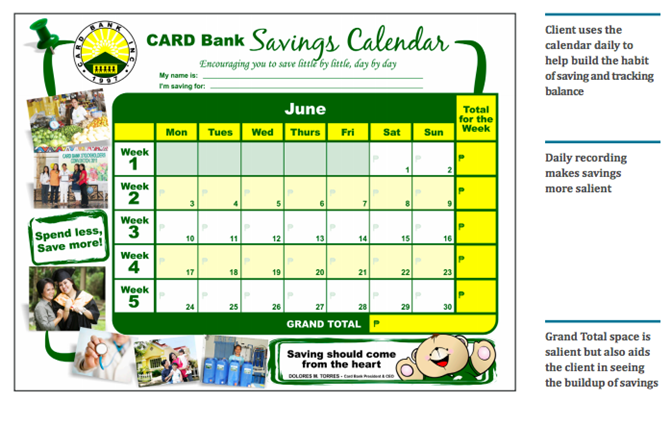

Lastly, clients were given a savings calendar, which allowed them to monitor their aggregate savings over time. There was an emphasis on daily savings to counter the potential anchor of the weekly minimums established by the bank. Additionally, each savings calendar contained a message from the Bank’s CEO, a respected member of the community to whom many of CARD Bank’s clients looked up, to further leverage the strong relationship between CARD Bank and its clients.

The new Savings Calendar

Example Text Messages:

Text message sent to all clients who opted to receive texts after opening an account:

Ang CARD Bank ay muling nagpapasalamat sa pagbubukas ninyo ng savings account! Ito ay paalala na sundin ang inyong Savings Plan at regular na mag deposito sa inyong account.

(CARD Bank thanks you again for opening a new savings account! This is a reminder to follow your Savings Plan and make regular deposits in your account.)

Text message sent to all clients who opted to receive texts 2, 4, 6 weeks after opening an account:

Paalala mula sa CARD Bank: Ipinapakita sa inyong Savings Calendar kung magkano na ang inyong naiimpok , maaaring sa linggong ito ay makapagdeposito na ng mas malaki.

(This is a reminder from CARD Bank. Your Savings Calendar shows how much you’ve been depositing—maybe this is the week to deposit a little bit more.)

Text message sent to all Bank staff members in charge of opening accounts on the first day of the pilot:

Tandaan: Ang CARD Bank savings pilot ay nagsimula noong nakaraang linggo. Kung may katanungan tungkol dito, lumapit lamang sa inyong CSO o Area Manager.

(Remember, the CARD Bank savings pilot started last week. If you have any questions about the pilot, please ask your CSO or Area Manager for help.)

Text message sent to all Bank staff members in charge of encoding data for the study on the first day of the pilot:

Tandaan: ang CARD Bank savings pilot ay nagsimula noong nakaraang linggo. Umaasa kami sa pag-encode ninyo ng data at pagpapadala nito sa amin tuwing Biyernes. Kung may katanungan, lumapit lamang sa inyong Area Manager.

(Remember, the CARD Bank savings pilot started last week. We’re counting on you to encode the data and send it every Friday. If you have any questions about the pilot, please ask your Area Manager for help.)

Impact

A randomized evaluation found that clients who received the redesigned savings program with the new account opening form, savings plan, and savings calendar, increased their final balances by 37%, from an average of 86 pesos among clients in the standard savings program to 118 pesos among those in the redesigned program. These clients made initial deposits that were 15% higher than those in the standard savings program. They were also 22 percentage points more likely to initiate a transaction in the new account, with 45% of clients with redesigned savings program making a transaction compared to only 23% of clients in the standard program.

In general, clients with the redesigned savings program made smaller and more frequent ongoing deposits as well as smaller withdrawals.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researcher:

- Choosing the correct automatic SMS messaging service is crucial to implementation. In this pilot, the chosen service did not send messages as frequently as intended. This experiment used both Clickatell and BulkSMS.

- It is always a challenge when you have humans engaged in a step of the randomization process. The intervention should be rolled out quickly after staff are trained in the new programs to reduce risk of staff members forgetting the nuances of the program design.

- Pay close attention to all of the details of the intervention as it goes into effect. Trust that staff will do what they are supposed to, but also verify early that it is actually being done the way that it was designed.

- Help people take action to save rather than provide them with information to mitigate the gap between intentions and actions.

Project Credits

Researchers:

Alexandra Fiorillo ideas42

Louis Potok ideas42

Josh Wright ideas42

Julie Peachey Grameen Foundation

Kimberly Davies Grameen Foundation