Encouraging Consumers to Claim Due Compensation

Organization : Financial Conduct Authority

Project Overview

Project Summary

The FCA worked with a UK firm to test behaviorally informed changes to letters sent to 200,000 customers, which were intended to help them pay better attention to the redress communication.

Impact

Salient bullet points at the top of the letter had the single largest effect, increasing response rates by over 2.5 times the control letter. The best performing combination of features increased the response rate by over seven times compared to the control.

Source

Source

Challenge

When firms in the UK do not follow the Financial Conduct Authority’s (FCA) Rules or Principles, and consumers incur financial losses as a result, the FCA seeks to ensure customers receive adequate compensation, or redress. In 2011/12, the FCA helped obtain over £150 million worth of redress for consumers. Instances where consumers are due redress do not often receive publicity. Instead, the firm alerts customers to a potential issue, usually in the form of a letter that gives customers information, which they need to answer. Yet some customers do not respond, even when it is in their interest to act. Reasons may be that the relevant information is obscured or more complex than necessary, or that consumers suffer from inertia, but firms may not have sufficient incentives to correct these issues on their own.

People receive a lot of mail, much of it advertising, and have to sift through it in a limited amount of time. They have to decide which letters to open, look at, and read. Even if a consumer reads a letter and intends to act on it, there may be further barriers to responding, or they may procrastinate and forget. Much of this decision-making is quick and automatic. Insights from behavioral science suggest how firms may help consumers pay suitable attention to communication about redress due to them.

Design

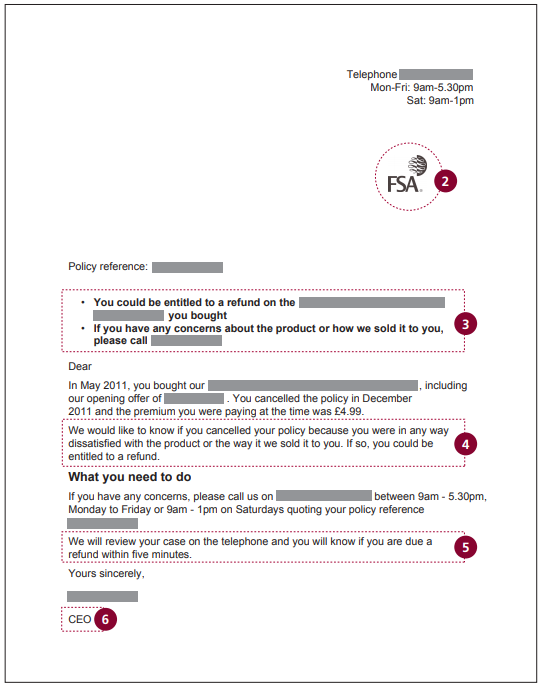

The FCA worked with a firm that was voluntarily writing to almost 200,000 customers about a failing in its sales process. To help consumers pay attention to the communication, the envelope would need to be appropriately distinctive to be opened, the key messages would need to be as salient and immediate as possible, and excess text would need to be reduced. The firm would need to reassure consumers that claiming redress will be easy and should remind people to respond.

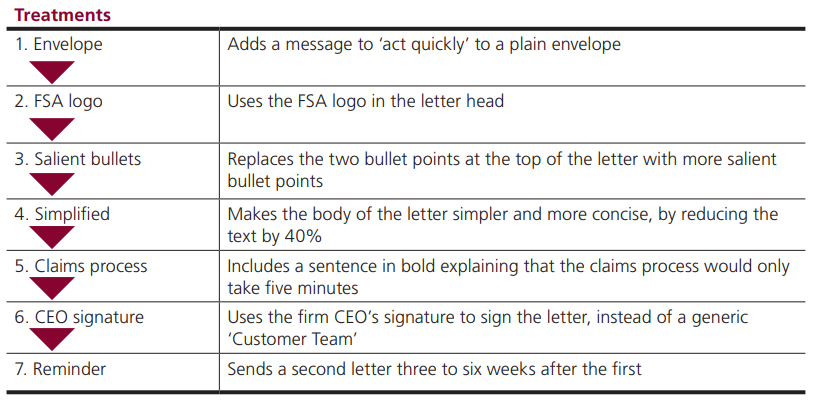

FCA developed changes to seven features of the communication, listed below in the order that consumers may receive them – envelope first, then top to bottom as they read the letter:

Over a five-week period, the firm contacted groups of consumers with various letters. Some received the original envelope and letter designed by the firm with no reminder letter (control), and others received random combinations of the seven features above, for a total of 128 possible combinations.

Impact

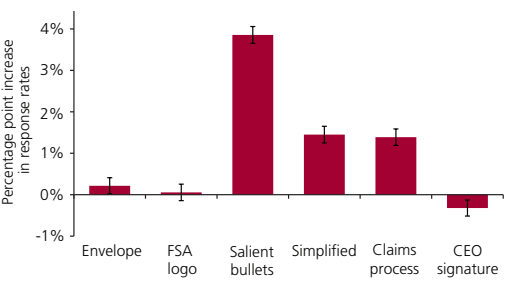

A randomized evaluation found that Salient bullets had the largest single effect, increasing response rates over 2.5 times compared to the original firm letter (from 1.5% to 5.3%). The Simplified and Claims process treatments each almost doubled the response rate. CEO signature unexpectedly had a small but statistically significant negative effect on response.

When the researchers explored interactions between the various treatments they found that Reminder, which was a copy of the original letter, has much more effect if it has Salient bullets – a positive interaction that improves response rates to almost 12%. Overall, the best letter combination increased the response rate by over seven times compared to the control.

Basic model of treatment effects, including 5% confidence intervals.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researcher:

- Difficulty in predicting results when applying psychological insights is common. We did not predict the overall pattern of results across the treatments, and did not expect any negative effects at all. This highlights the importance of directly testing designs rather than extrapolating results from different contexts.

- Reminder letters were sent out between three and six weeks after the original letter. Responses are significantly higher when sent at the three-week point.

- There were differences in response across age groups. Older age groups respond far more to the control letter than the middle-aged, who respond the least. For the best intervention letter, the young respond the least and response increases with age, suggesting the greatest relative effect on the middle-aged, who are likely the busiest.

Project Credits

Researchers:

Paul Adams Financial Conduct Authority

Stefan Hunt Financial Conduct Authority