Financial Training for Entrepreneurs

Organizations : ideas42, Innovations for Poverty Action

Project Overview

Project Summary

A financial literacy course teaches micro-entrepreneurs basic “rules of thumb” for running a business, such as separating business and personal accounts, paying oneself a fixed salary, and reconciling accounts.

Impact

The rules-of-thumb training led to improved financial practices and reporting quality, and increased business revenue for micro-entrepreneurs.

Challenge

A standard approach to small business training is designed to teach double-entry accounting, working capital management, and investment decisions. While this standard approach can be both complex and comprehensive, it has not been shown to be very effective in improving micro-entrepreneurs’ accounting practices or increasing their business revenue.

ADOPEM, a microfinance institution that lends to individuals and small businesses in the Dominican Republic, worked with researchers and Dominican training experts to develop a better financial literacy training for its clients.

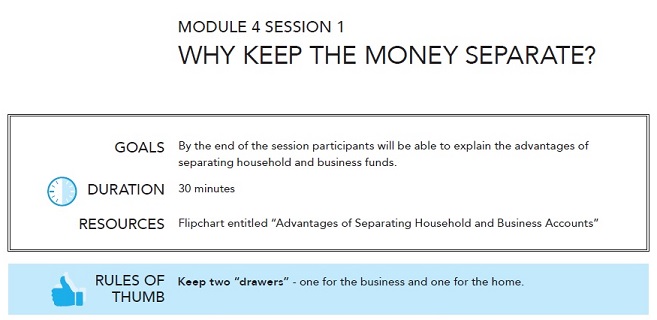

Design

The training focused on communicating simple routines for financial decision-making, instead of building comprehensive accounting knowledge. For example, training modules teach business owners to separate their business and personal accounts by using typical accounting methods for calculating business profits. The rules-of-thumb training taught participants to simply keep their money in two separate drawers (or purses) and to only transfer money from one drawer to the other with an explicit “IOU” note between the business and the household. At the end of the month they could then count how much money was in the business drawer to calculate their profits.

Excerpt from Rules of Thumb training guide

In addition to presenting several strategies for physically separating business and personal funds, the rules-of-thumb treatment taught:

- How to estimate profits by tracking simple changes in business cash-on-hand,

- The importance of paying oneself a fixed salary,

- Strategies for distinguishing business and personal expenses, and

- Easy-to-implement tools for reconciling accounts when business funds have been used for personal expenses (or vice versa).

Training guide excerpt with group exercise

Clients received record-keeping books, handouts, and homework assignments to reinforce ideas or techniques from the meetings. The classes were offered once a week for three hours at a time. The first three classes covered consumption, savings, and debt management. Classes four and five focused on separating business and personal money and estimation techniques for calculating profits.

All courses were taught by qualified local instructors. The majority had university degrees and experience with adult education, in most cases with ADOPEM directly. Courses were offered at seven schools throughout Santo Domingo and scheduled based on students’ preferences. In addition, the course was heavily subsidized. Fees were randomly assigned at 200 Dominican pesos (approximately $6 USD) or zero, relative to an overall program cost of approximately 700 Dominican pesos.

Impact

A randomized evaluation found that business owners offered the rules-of-thumb training were significantly better at managing their finances and were more accurate and consistent in the numbers they reported, compared to a group that received a standard accounting training. Business owners who received the rules-of-thumb training were more likely to keep accounting records, calculate monthly revenues, and separate their books for the business and the home. Improvements in these accounting practices were on the order of 10 percentage points on average. In contrast, the standard accounting training did not produce any significant changes in accounting practices.

Participants in the rules-of-thumb group also reported a significant increase in business revenue. The most significant effect was observed in the level of sales during bad weeks.

For those with lower skills or poor initial financial practices, the impact of the rules-of-thumb training was even larger, suggesting that simplifying training programs might improve their effectiveness for business owners with the lowest level of accounting skills.

What worked best

- Teaching heuristics to business owners with the lowest financial skills and poor initial accounting practices. In the study, this group saw the largest gains.

- Note that only the simple rules-of-thumb training had positive impacts on businesses. The conventional accounting class, similar to those offered by many financial institutions, had no impact.

Implementation Guidelines

Inspired to implement this design in your own work? Here are some things to think about before you get started:

- Are the behavioral drivers to the problem you are trying to solve similar to the ones described in the challenge section of this project?

- Is it feasible to adapt the design to address your problem?

- Could there be structural barriers at play that might keep the design from having the desired effect?

- Finally, we encourage you to make sure you monitor, test and take steps to iterate on designs often when either adapting them to a new context or scaling up to make sure they’re effective.

Additionally, consider the following insights from the design’s researcher:

- Make the teaching and material as accessible as possible. You may choose to rely heavily on role playing and practice sessions.

- Make the logistics of training convenient so that participants are able to attend.

Would this work elsewhere?

Simplifying training programs and relying more on easy-to-implement, practical rules of thumb, could produce significant gains for small-scale business owners in many contexts, especially in emerging markets. In these contexts, many small businesses are run by owners who have very little prior accounting knowledge or even literacy. In addition, these small and medium enterprise (SME) owners typically have limited time and attention to focus on complex new practices such as keeping detailed books.

Replications, which are ongoing, may bolster these findings and provide further insight into what drives the effects, and the cost-effectiveness of the approach.

Cost effectiveness

For existing training programs, switching to a rules-of-thumb curriculum will carry one-time start-up costs, som e of which are detailed below. In the longer run, however, rules-of-thumb curricula may make training instructors easier and shorten implementation time, saving personnel time and allowing for more students to be trained more efficiently.

Costs you are likely to encounter include:

- Costs associated with developing a rules-of-thumb curriculum, including hiring or consulting with experts and piloting new materials

- Hiring and training instructors in the rules-of-thumb curriculum

- Marketing costs, if you decide to advertise the new curriculum to attract students

Project Credits

Researchers:

Alejandro Drexler Contact London School of Economics and Political Science

Gregory Fischer Federal Reserve Bank of Chicago

Antoinette Schoar Massachusetts Institute of Technology, ideas42