Increasing Engagement with Mobile Banking in Nigeria

Organizations : Busara Center for Behavioral Economics, ideas42

Project Overview

Project Summary

ideas42 and Busara Center for Behavioral Economics worked with a major bank and telecommunications company in Nigeria to send behaviorally-informed SMS messages to customers to increase their use of mobile bank accounts.

Impact

Effects varied by message and audience; notably, injunctive norm messages led to a 45 percent increase in the number of clients making deposits among females with active accounts, from 0.82% to 1.81%.

Challenge

In 2014, only 48.6% of Nigeria’s adult population had access to, and used, formal financial products. To make these products more accessible to people of all incomes, a major bank and a telecommunications company in Nigeria jointly launched a mobile bank account. Mobile banking is often seen as easier for people to use and is cheaper to offer to customers who are otherwise difficult to reach.

However, the majority of the mobile bank accounts were dormant or under-used. Recognizing that the bank was already investing in SMS campaigns to reach out to customers, the researchers developed SMS interventions to encourage customers, particularly women (who access and use banking products at a lower rate than men in Nigeria), to use their accounts. The researchers used both qualitative and quantitative methods to identify several barriers to deposits and account usage. Amongst the set of barriers identified, this first SMS campaign was designed to address the following two behavioral bottlenecks:

1) Customers primarily used the mobile banking product as a vehicle for buying call credits (i.e., airtime)- as opposed to seeing it as a mechanism for accumulating savings

2) Customers did not trust the product and did not observe many of their peers using it

Design

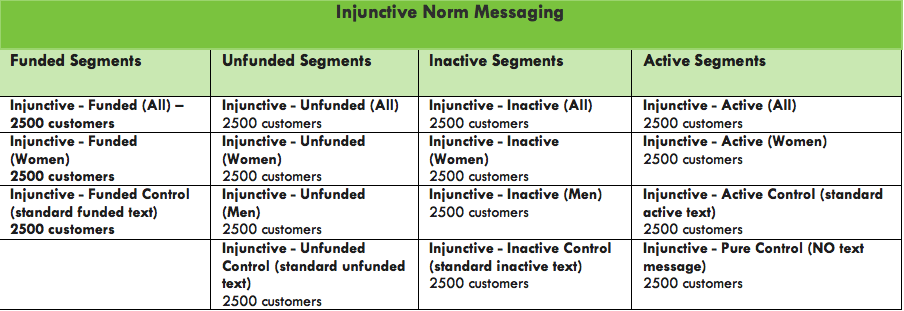

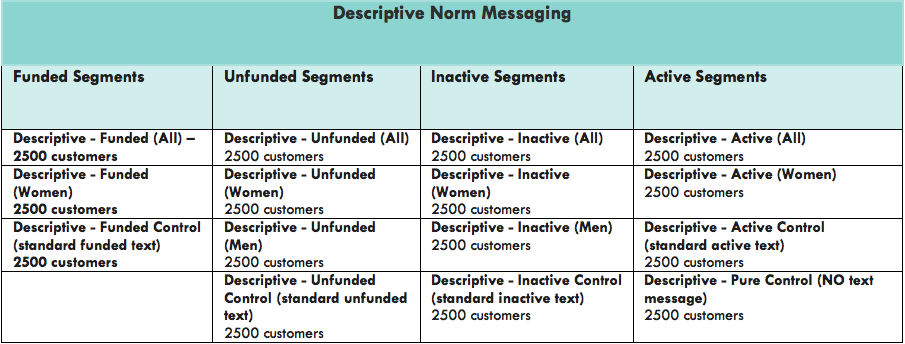

ideas42 and the Busara Center for Behavioral Economics designed SMS campaigns that the bank and telecommunications company delivered over the course of a week. (Each sub-group was delivered three messages in total.) The total sample size of the intervention was 75,000 customers.

These designs particularly utilized “social norms”, or the idea that people’s choices are significantly influenced by the behavior of others. Understanding a norm can provide individuals with helpful guidance in situations of uncertainty. One set of messages utilized “injunctive norms”( i.e., what one ought to do) and provided recommended savings levels that customers should have in their account. This was done to set a goal and shift the perception of the account away from an airtime buying vehicle to one that can accumulate savings over time. The amount defined, 2,000 Naira (about $5.50 US dollars), was small, but it was a meaningful increase in savings balance among target users and was intended to give a threshold for “good” savings behavior.

The other set of messages (descriptive norms, i.e., what others are doing) highlighted the widespread usage of the product by customers’ peer groups. The test sample was split into the following segments to see if the messages affected different types of customers in different ways: women vs men, inactive vs active customers, customers with money in their accounts vs customers with zero balance [i.e. funded and unfunded]).

In addition to these two treatment groups and a pure control group that received no messages, each segment also had a treatment group that received standard messages previously sent out by the bank and telecommunication company. This standard message control was included so that researchers could disentangle the effect of receiving any message from receiving a message with social norms framing.

Impact

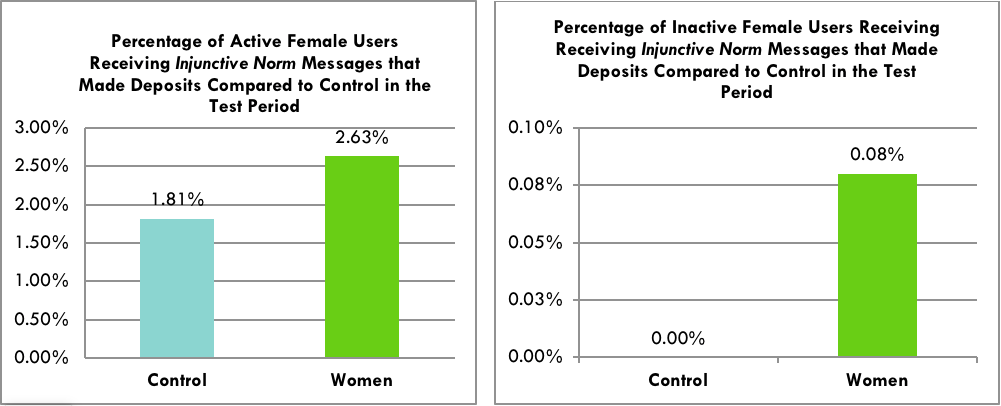

Injunctive norm messages resulted in increased deposits by women with active accounts with a 0.82 percentage point increase in treatment from a baseline rate of 1.81% in the control (45% increase in treatment compared to the control, p<0.05), as well as by women with inactive accounts (0.08% of inactive women in treatment deposited compared to 0% in control, p<0.10).

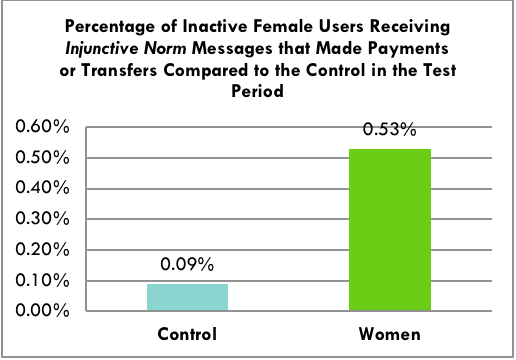

Injunctive norm messages also increased transfers and/or payments in women’s inactive accounts with a 0.44 percentage point increase in treatment from a baseline rate of 0.09% in the control (approximately a fivefold increase in treatment compared to control, p<0.05).

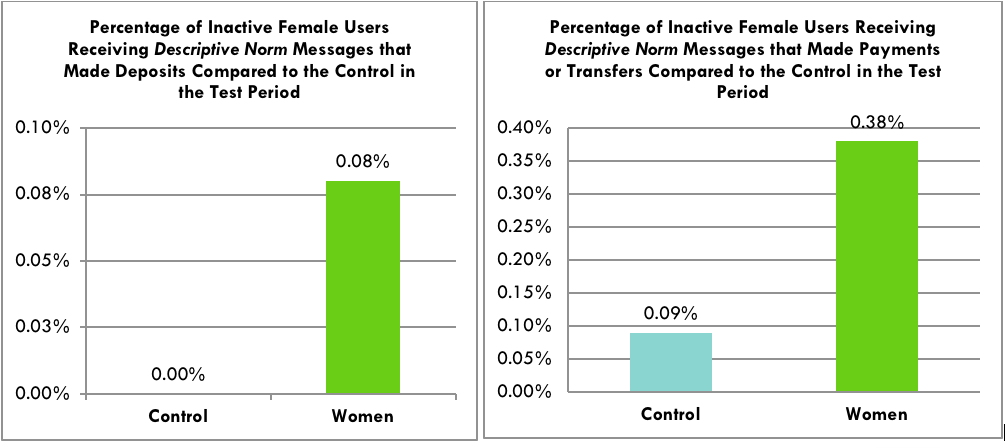

Descriptive norm messages increased deposits by inactive women users; 0.08% of inactive women users in the treatment made a deposit compared to 0% in control (p<0.10).

Descriptive norm messages also increased transfers and/or payments by women with inactive accounts with a 0.29 percentage point increase in treatment from a baseline rate of 0.09% in the control (approximately a fourfold increase in treatment compared to control, p<0.05).

There were no noticeable differences in behavior among funded or unfunded accounts (e.g., accounts with positive vs zero balance) nor men’s active or inactive accounts compared to the control group.

Implementation Guidelines

While SMS interventions are often low cost, organizations should make sure to allocate a budget for sending the messages. The budget will depend on the minimum number of people that will need to be messaged, the cost per message in the local context as well as the duration of the intervention. When choosing a messaging platform, a desirable feature to look for is the ability to obtain delivery confirmation on whether customers received the messages or not (this may increase the total cost). Another cost to consider is the staff allocations for drafting and getting messages approved. Once the messages are drafted, they may need to be approved by several departments within an organization (often the legal, marketing, or customer engagement department head). To make the process smoother, develop a schedule for discussing the messages and making revisions based on the feedback from all stakeholders.

Further, while we were fortunate that our target segments were of interest to the bank and telecommunication company we worked with, pulling unique sets of customers can often be burdensome for the financial institution, especially as the segment gets more specific. Where possible, being able to identify pre-existing or pre-established segments already used by the institution can make sample selection and randomization far smoother.

Project Credits

Researchers:

Kanyinsola Aibana Contact ideas42

Jiyoung Han ideas42

Clara Zeller Busara Center for Behavioral Economics

James Vancel Busara Center for Behavioral Economics