Increasing Use of Mobile Check Deposit

Organizations : Alliant Credit Union, ideas42

Project Overview

Project Summary

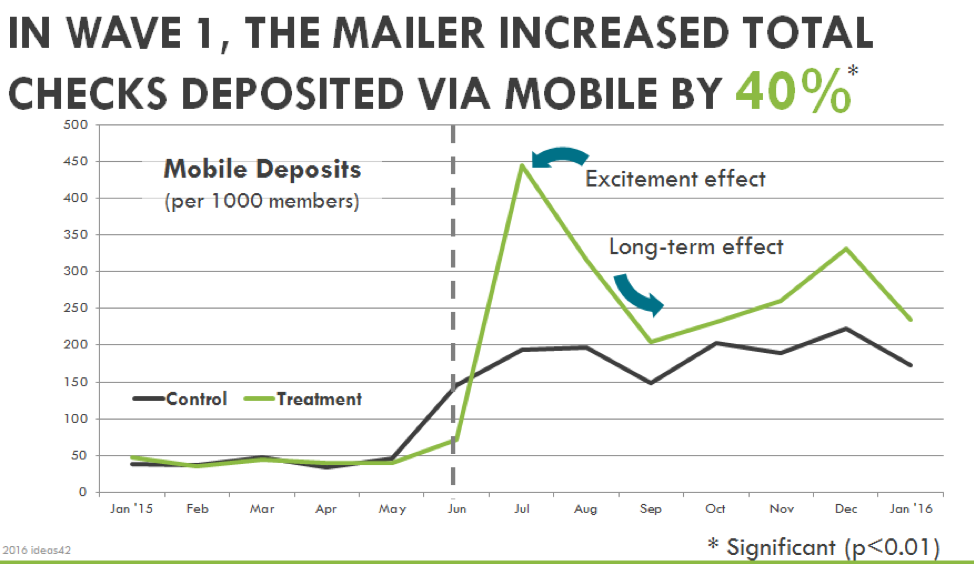

Alliant Credit Union members who deposit most of their checks at their local branch or through the mail were sent a letter encouraging them to try mobile deposits. The letter included a set of easy-to-follow instructions for making a deposit using the smartphone app, and a $5 check to encourage people to try and make a deposit immediately.

Impact

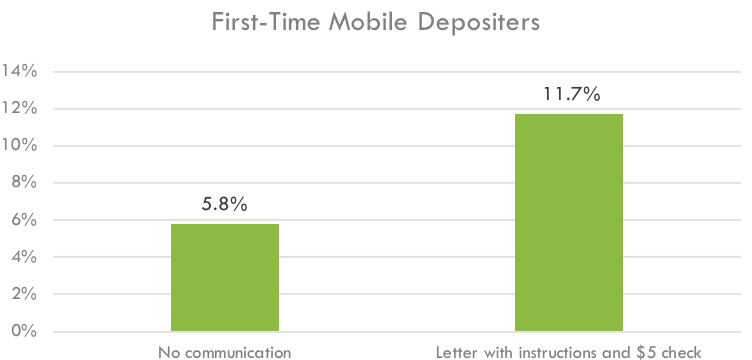

Letters increased the number of clients making mobile deposits for the first time by 5 percentage points compared to members who received no communication about mobile deposits, from 5.8% to 11.7%.

Cost

Less than $1 per envelope sent. $5 per check mailed and subsequently deposited with mobile app.

Challenge

In early 2014, usage rates of Alliant’s mobile application for check deposits, while rising, were still lower than expected: almost 90% of branch and mail depositors had not tried to use mobile deposit. This was an industry-wide problem; uptake of mobile banking was below 20% at most major financial institutions.

Design

Analysis of Alliant deposit data revealed that while a few members used mobile deposits, members who made at least one mobile deposit were likely to make subsequent deposits. Therefore, ideas42 worked with Alliant to create a “Mobile Deposit Starter Kit,” targeting members who had demonstrated little to no use of mobile deposits. The goal was to demonstrate the ease of making a mobile deposit, and thus encourage members to shift future deposits from mail and branch channels to mobile deposits.

Analysis of Alliant deposit data revealed that while a few members used mobile deposits, members who made at least one mobile deposit were likely to make subsequent deposits. Therefore, ideas42 worked with Alliant to create a “Mobile Deposit Starter Kit,” targeting members who had demonstrated little to no use of mobile deposits. The goal was to demonstrate the ease of making a mobile deposit, and thus encourage members to shift future deposits from mail and branch channels to mobile deposits.

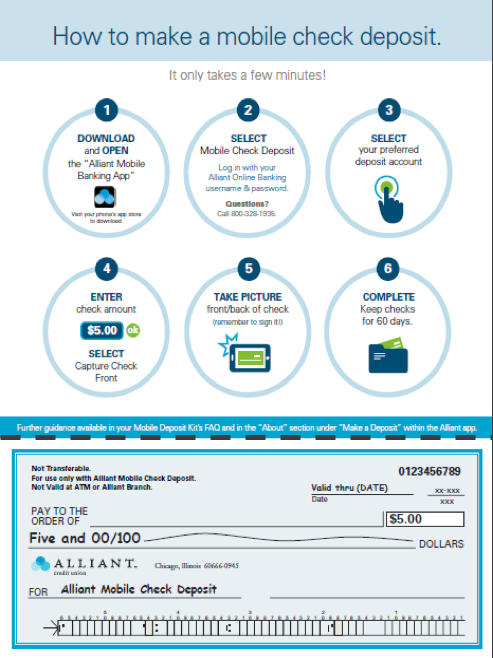

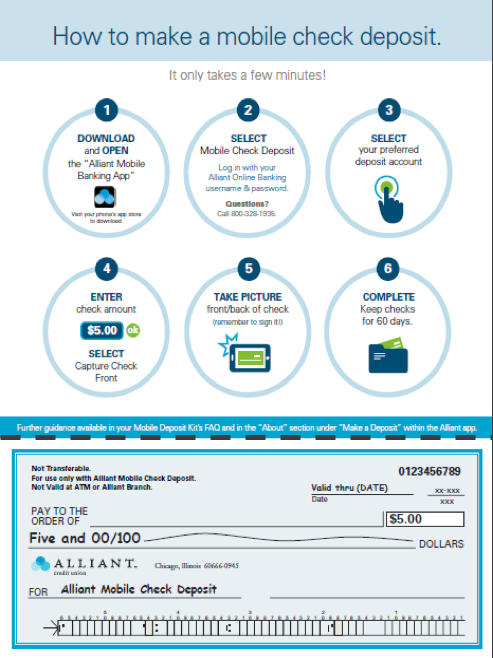

The Mobile Deposit Starter Kit included a personalized letter welcoming the member to start using mobile deposits and a set of easy to follow instructions for downloading the mobile app and making the first mobile deposit. The mailer also included a $5 practice check giving members a chance to immediately put the instructions into practice and make their first mobile deposit. Beyond providing a small financial incentive, the practice check was integral to getting members to build a new sustainable habit of mobile check deposits.

The mailers were sent to a random selection of 3,459 Alliant members.

Impact

The mailers raised the adoption rate of mobile deposits by almost 6 percentage points, doubling the number of members making mobile deposits (from 5.8% to 11.7%). Additionally, six months later, mailer recipients allocated 60% more checks toward mobile deposits (16.3% as compared to 10.3% in the control condition). Finally, the most powerful result of the mailer was that it increased the total number of checks deposited by Alliant members across all channels – not just mobile deposits! These deposits, which would otherwise have been deposited at a different financial institution, increased total deposits by approximately $2.7 million.

Implementation Guidelines

The Mailer included five parts:

1. The Envelope: The mailer was sent in a slightly large envelope (6” x 9”) which was more likely to get noticed in the flurry of standard letter sized envelopes (4 1/8 ” x 9 ½”), and the cover of the envelope included messaging to make recipients curious of the contents inside.

1. The Envelope: The mailer was sent in a slightly large envelope (6” x 9”) which was more likely to get noticed in the flurry of standard letter sized envelopes (4 1/8 ” x 9 ½”), and the cover of the envelope included messaging to make recipients curious of the contents inside.

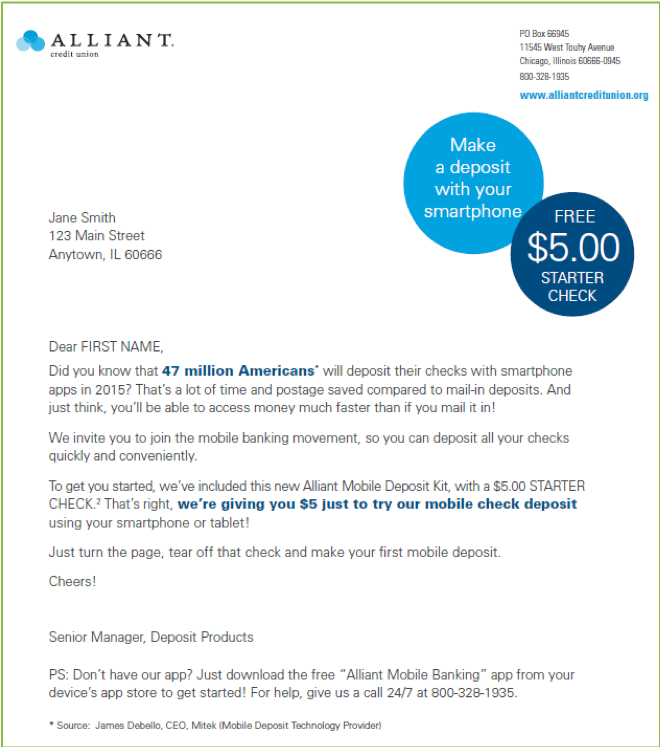

2. The Letter: The key objective of the letter was to explain to the member why they received this mailer, and why they should use mobile deposits. The letter included:

a. Personalization: it is addressed to the member’s first name.

b. Call-out bubbles and bolding: highlight key messages of the mailer

c. Social Norms: showing the number of people currently using mobile deposits, makes the platform seem popular and safe.

d. Direct comparison to alternatives: the mailer makes clear the benefit of mobile deposits over their current channels.

e. Explanation of starter check: make clear there are no strings attached for the money.

f. Highlight action step: make clear to the recipient what action they should take right now (turn, page, tear off the check, make deposit)

g. Personalized signature: builds feelings of reciprocity when connected with a real person.

h. Post-script: Most likely to be skipped down and read – includes key salient information if the person feels lost.

3. Instructions: The instructions were designed to make the process seem as easy as possible. They only include steps we expected would be difficult to perform when using the app. Furthermore, the layout (bubbles) makes the process seem shorter and more manageable than a six part numbered list.

4. Check: The check included messaging to encourage people to deposit it using mobile deposits. We printed the check directly under the instructions to make sure it was as visible as possible!

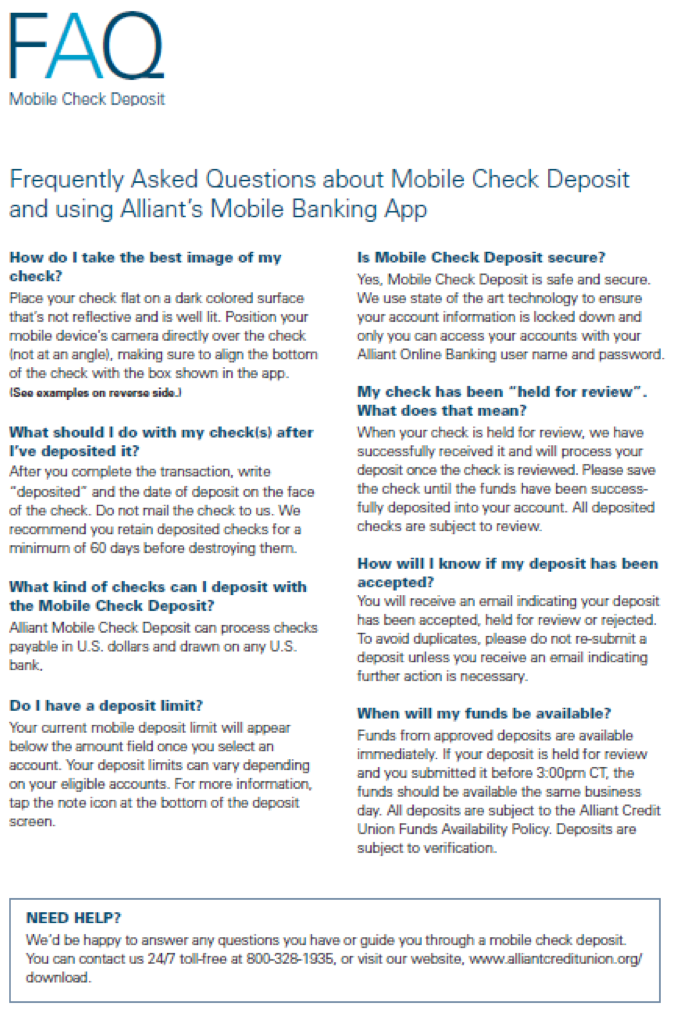

5. FAQ: As a third and final page of the mailer, we included a set of frequently asked questions. This was included at the back of the mailer, as it was less important than the letter, instructions and check. The FAQ included elements that might be of concern to some members such as the safety of mobile deposits, and the amount of time it takes to post the money in their account. Great care was made in the writing of the FAQ to ensure that the language was easy to understand, did not include too technical terms, and directly addressed the potential concerns of the recipient.

Project Credits

Page submitted by:

Alliant Credit Union More projects from this organization More projects from this organization

More projects from this organization